- MimiVsJames 美股輕鬆談

- Posts

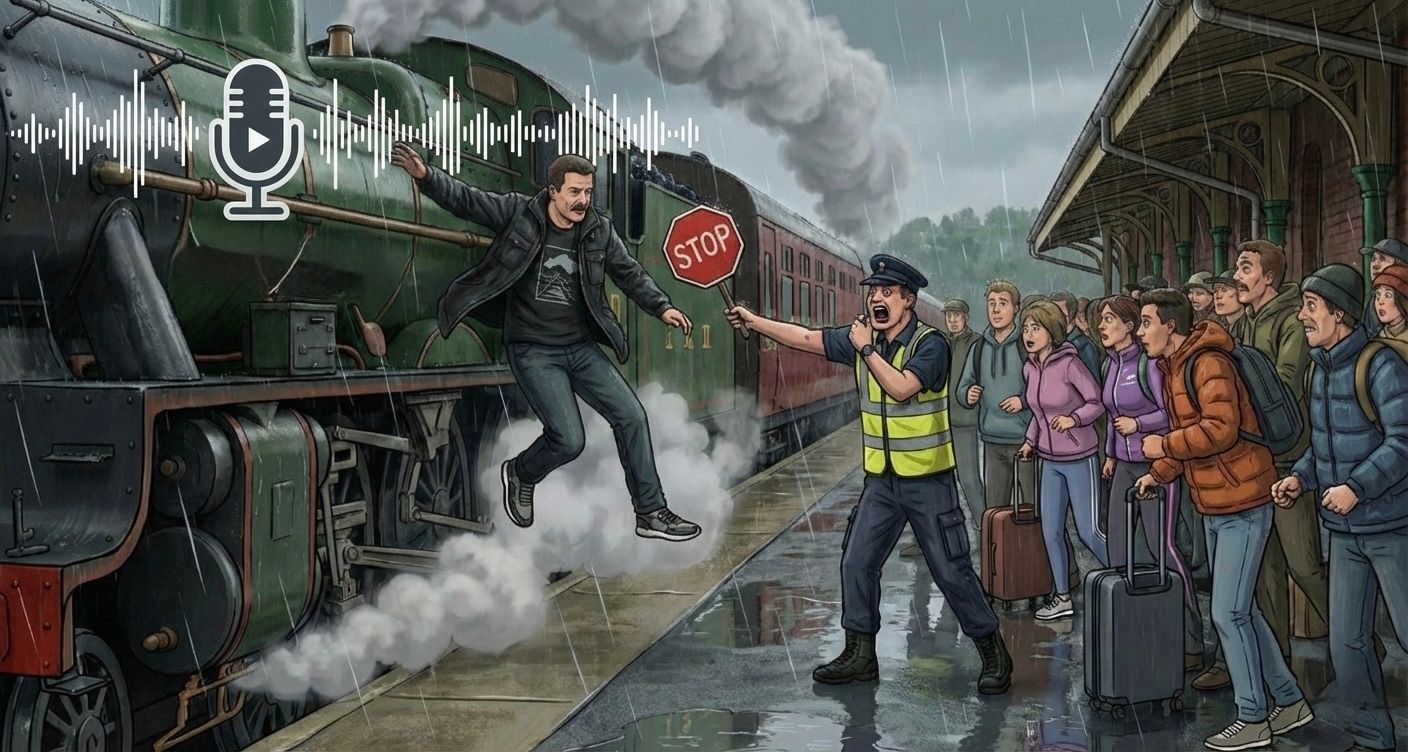

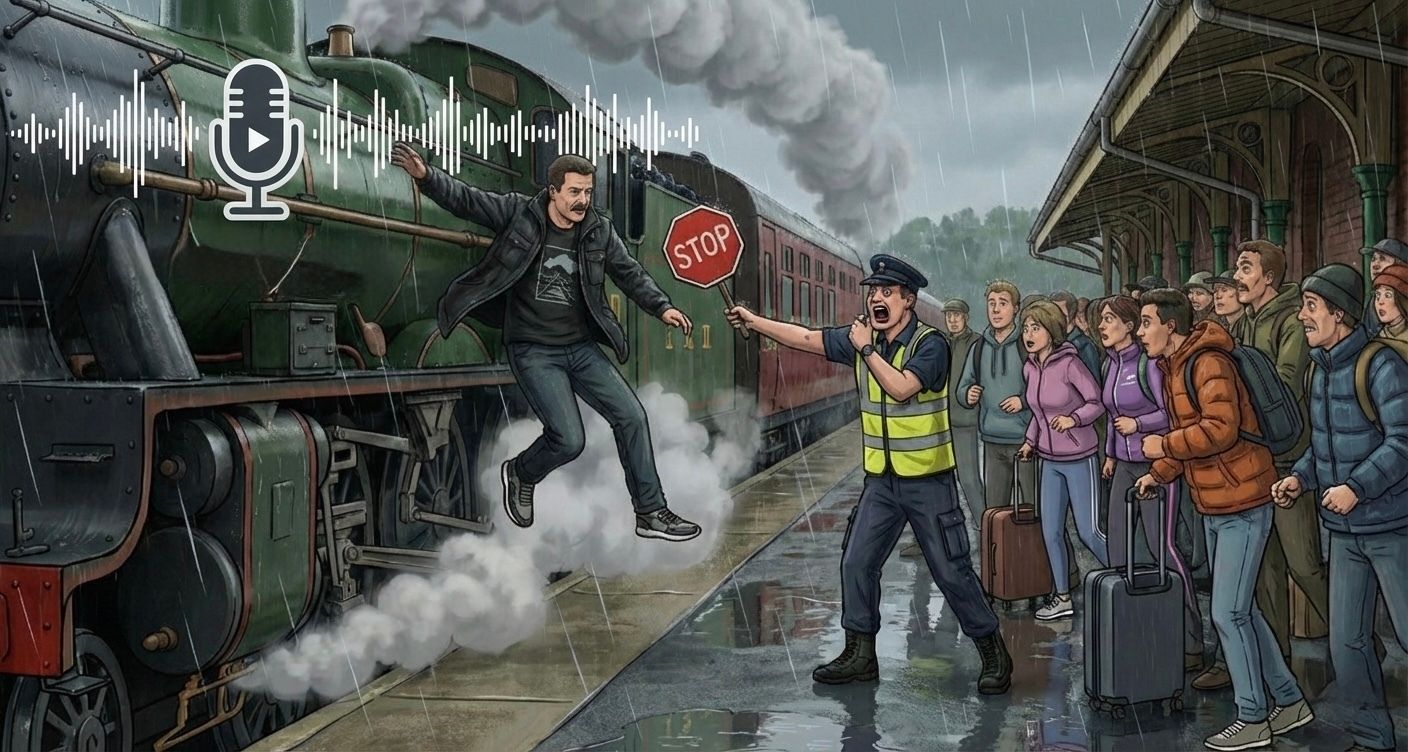

- 為什麼我用布林帶賣太早?買太慢?不是叫你賣而是叫你上車的訊號(語音篇)

為什麼我用布林帶賣太早?買太慢?不是叫你賣而是叫你上車的訊號(語音篇)

小白最常誤用布林帶的「六個陷阱」跟「正確用法」教學,讓你搞懂什麼才是趨勢

別猴急下車…

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Reply